Page 266 - Vol...1

P. 266

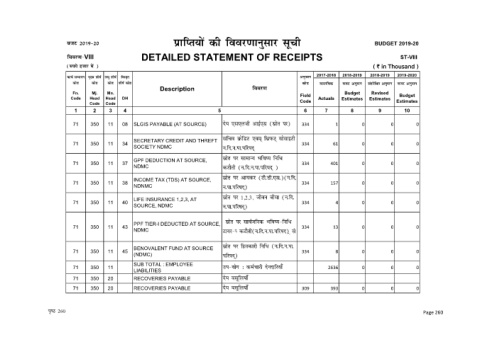

izkfIr;ksa dh fooj.kkuqlkj lwph

ctV 2019&20 BUDGET 2019-20

fooj.k&VIII DETAILED STATEMENT OF RECEIPTS ST-VIII

(#i;s gtkj esa ) ( ` in Thousand )

dk;Z lEiknu eq[; 'kh"kZ y?kq 'kh"kZ foLr`r vuqHkkx 2017-2018 2018-2019 2018-2019 2019-2020

dksM dksM dksM 'kh"kZ dksM dksM okLrfod ctV vuqeku la'kksf/r vuqeku ctV vuqeku

Description fooj.k

Fn. Mj. Mn. Field Budget Revised Budget

Code Head Head DH Actuals Estimates Estimates

Code Code Code Estimates

1 2 3 4 5 6 7 8 9 10

71 350 11 08 SLGIS PAYABLE (AT SOURCE) ns; ,l,yth vkbZ,l (lzksr ij)

0

0

0

334

1

SECRETARY CREDIT AND THREFT lfpo ozQsfMV ,oe~ fFkziQV~ lkslkbVh

71 350 11 34 334 61 0 0 0

SOCIETY NDMC u-fn-u-ik-ifj"kn~

GPF DEDUCTION AT SOURCE, lzksr ij lkekU; Hkfo"; fuf/

71 350 11 37 334 401 0 0 0

NDMC dVkSrh (u-fn-u-ik-ifj"kn~ )

INCOME TAX (TDS) AT SOURCE, lzksr ij vk;dj (Vh-Mh-,l-)(u-fn-

71 350 11 38 334 157 0 0 0

NDNMC u-ik-ifj"kn~)

LIFE INSURANCE 1,2,3, AT lzksr ij 1]2]3] thou chek (u-fn-

71 350 11 40 334 4 0 0 0

SOURCE, NDMC u-ik-ifj"kn~)

PPF TIER-I DEDUCTED AT SOURCE, lzksr ij lkoZtfud Hkfo";&fuf/

71 350 11 43 334 13 0 0 0

NDMC Vk;j&I dVkSrh(u-fn-u-ik-ifj"kn)~ ls

BENOVALENT FUND AT SOURCE lzksr ij fgrdkjh fuf/ (u-fn-u-ik-

71 350 11 45 334 8 0 0 0

(NDMC) ifj"kn~)

SUB TOTAL : EMPLOYEE

0

2636

71 350 11 mi&;ksx % deZpkjh nsunkfj;k¡

0

0

LIABILITIES

71 350 20 RECOVERIES PAYABLE ns; olwfy;k¡

71 350 20 RECOVERIES PAYABLE ns; olwfy;k¡

0

309

0

0

393

i`"B 260 Page 260

ctV 2019&20 izkfIr;ksa dh fooj.kkuqlkj lwph BUDGET 2019-20

fooj.k&VIII DETAILED STATEMENT OF RECEIPTS ST-VIII

(#i;s gtkj esa ) ( ` in Thousand )

dk;Z lEiknu eq[; 'kh"kZ y?kq 'kh"kZ foLr`r vuqHkkx 2017-2018 2018-2019 2018-2019 2019-2020

dksM dksM dksM 'kh"kZ dksM dksM okLrfod ctV vuqeku la'kksf/r vuqeku ctV vuqeku

Description fooj.k

Fn. Mj. Mn. Field Budget Revised Budget

Code Head Head DH Code Actuals Estimates Estimates Estimates

Code Code

1 2 3 4 5 6 7 8 9 10

0

0

71 350 11 08 SLGIS PAYABLE (AT SOURCE) ns; ,l,yth vkbZ,l (lzksr ij)

1

334

0

SECRETARY CREDIT AND THREFT lfpo ozQsfMV ,oe~ fFkziQV~ lkslkbVh

71 350 11 34 334 61 0 0 0

SOCIETY NDMC u-fn-u-ik-ifj"kn~

GPF DEDUCTION AT SOURCE, lzksr ij lkekU; Hkfo"; fuf/

71 350 11 37 334 401 0 0 0

NDMC dVkSrh (u-fn-u-ik-ifj"kn~ )

INCOME TAX (TDS) AT SOURCE, lzksr ij vk;dj (Vh-Mh-,l-)(u-fn-

71 350 11 38 334 157 0 0 0

NDNMC u-ik-ifj"kn~)

LIFE INSURANCE 1,2,3, AT lzksr ij 1]2]3] thou chek (u-fn-

71 350 11 40 334 4 0 0 0

SOURCE, NDMC u-ik-ifj"kn~)

lzksr ij lkoZtfud Hkfo";&fuf/

PPF TIER-I DEDUCTED AT SOURCE,

71 350 11 43 334 13 0 0 0

NDMC Vk;j&I dVkSrh(u-fn-u-ik-ifj"kn)~ ls

lzksr ij fgrdkjh fuf/ (u-fn-u-ik-

BENOVALENT FUND AT SOURCE

71 350 11 45 334 8 0 0 0

(NDMC) ifj"kn~)

SUB TOTAL : EMPLOYEE

0

0

71 350 11 mi&;ksx % deZpkjh nsunkfj;k¡

2636

0

LIABILITIES

71 350 20 RECOVERIES PAYABLE ns; olwfy;k¡

0

393

71 350 20 RECOVERIES PAYABLE ns; olwfy;k¡

309

0

0

i`"B 260 Page 260