Page 122 - Vol...2

P. 122

ctV 2019-20 BUDGET 2019-20

fooj.k XIII ST-XIII

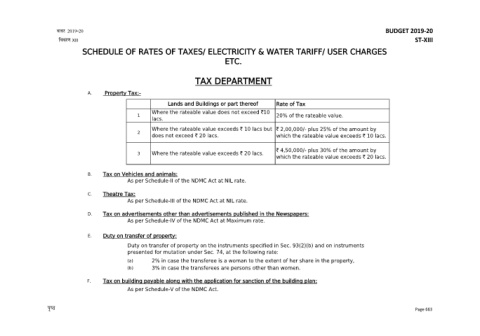

SCHEDULE OF RATES OF TAXES/ ELECTRICITY & WATER TARIFF/ USER CHARGES

ETC.

TAX DEPARTMENT

A. Property Tax:-

Lands and Buildings or part thereof Rate of Tax

Where the rateable value does not exceed `10

1 20% of the rateable value.

lacs.

Where the rateable value exceeds ` 10 lacs but ` 2,00,000/- plus 25% of the amount by

2

does not exceed ` 20 lacs. which the rateable value exceeds ` 10 lacs.

` 4,50,000/- plus 30% of the amount by

3 Where the rateable value exceeds ` 20 lacs.

which the rateable value exceeds ` 20 lacs.

B. Tax on Vehicles and animals:

As per Schedule-II of the NDMC Act at NIL rate.

C. Theatre Tax:

As per Schedule-III of the NDMC Act at NIL rate.

D. Tax on advertisements other than advertisements published in the Newspapers:

As per Schedule-IV of the NDMC Act at Maximum rate.

E. Duty on transfer of property:

Duty on transfer of property on the instruments specified in Sec. 93(2)(b) and on instruments

presented for mutation under Sec. 74, at the following rate:

(a) 2% in case the transferee is a woman to the extent of her share in the property,

(b) 3% in case the transferees are persons other than women.

F. Tax on building payable along with the application for sanction of the building plan:

As per Schedule-V of the NDMC Act.

i`"B 663 Page 663

ctV 2019-20 BUDGET 2019-20

fooj.k XIII ST-XIII

SCHEDULE OF RATES OF TAXES/ ELECTRICITY & WATER TARIFF/ USER CHARGES

ETC.

TAX DEPARTMENT

A. Property Tax:-

Lands and Buildings or part thereof Rate of Tax

Where the rateable value does not exceed `10

1 20% of the rateable value.

lacs.

Where the rateable value exceeds ` 10 lacs but ` 2,00,000/- plus 25% of the amount by

2

does not exceed ` 20 lacs. which the rateable value exceeds ` 10 lacs.

` 4,50,000/- plus 30% of the amount by

3 Where the rateable value exceeds ` 20 lacs.

which the rateable value exceeds ` 20 lacs.

B. Tax on Vehicles and animals:

As per Schedule-II of the NDMC Act at NIL rate.

C. Theatre Tax:

As per Schedule-III of the NDMC Act at NIL rate.

D. Tax on advertisements other than advertisements published in the Newspapers:

As per Schedule-IV of the NDMC Act at Maximum rate.

E. Duty on transfer of property:

Duty on transfer of property on the instruments specified in Sec. 93(2)(b) and on instruments

presented for mutation under Sec. 74, at the following rate:

(a) 2% in case the transferee is a woman to the extent of her share in the property,

(b) 3% in case the transferees are persons other than women.

F. Tax on building payable along with the application for sanction of the building plan:

As per Schedule-V of the NDMC Act.

i`"B 663 Page 663